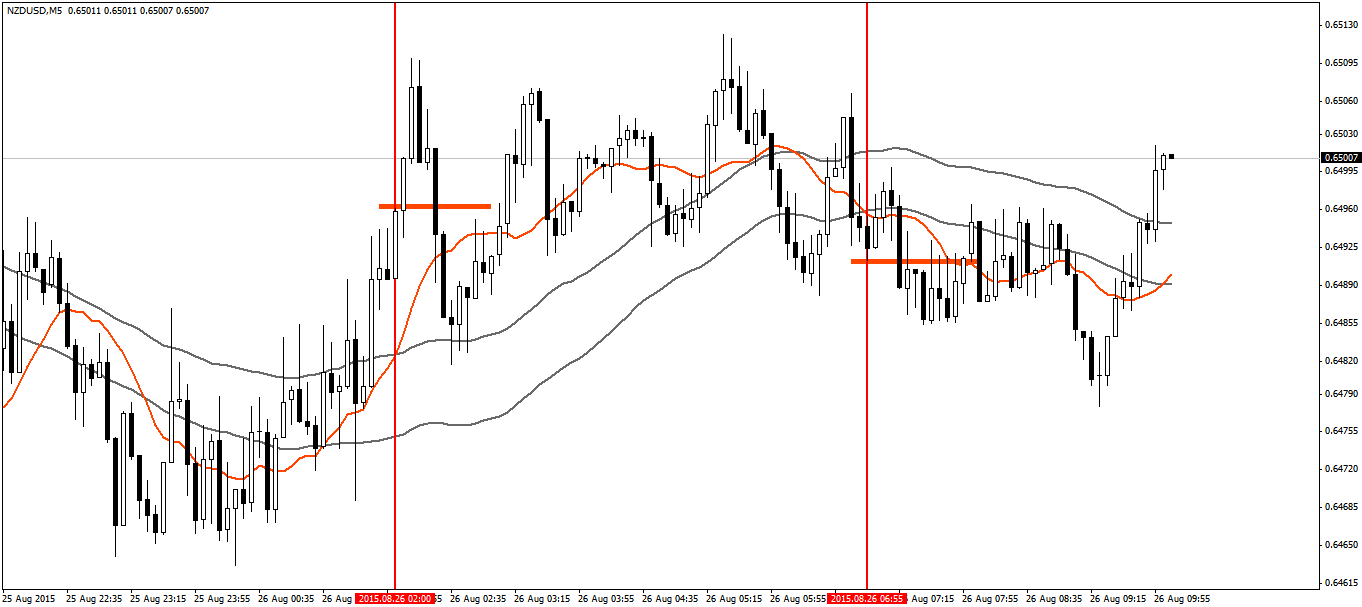

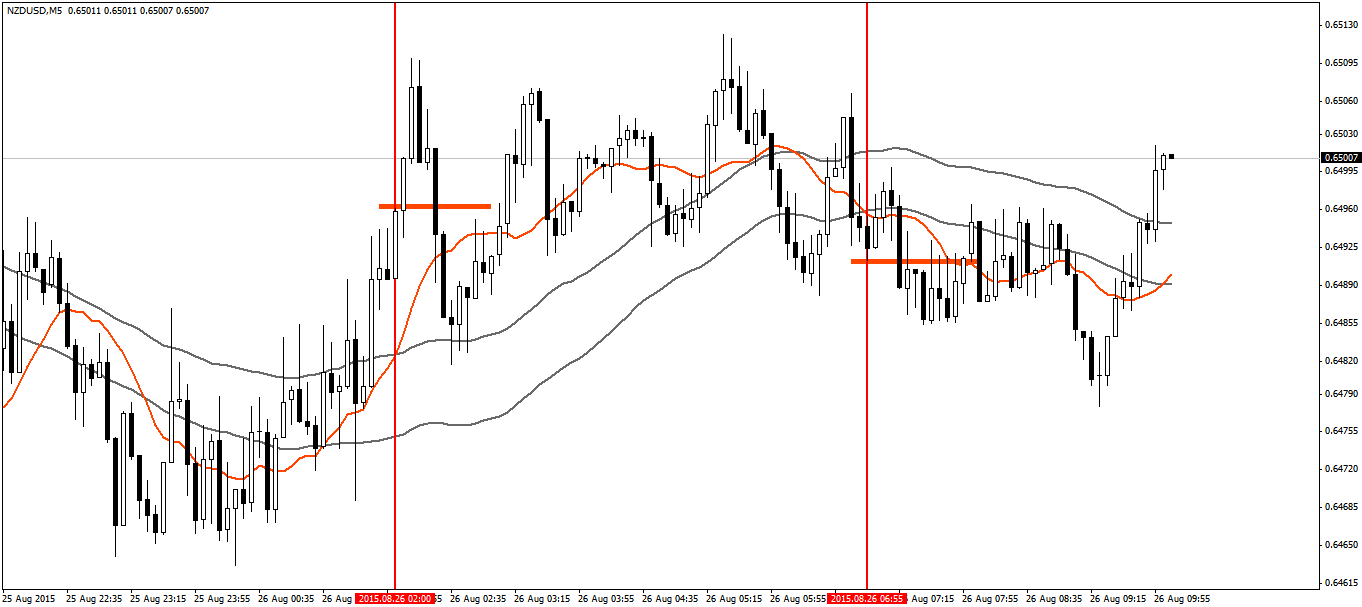

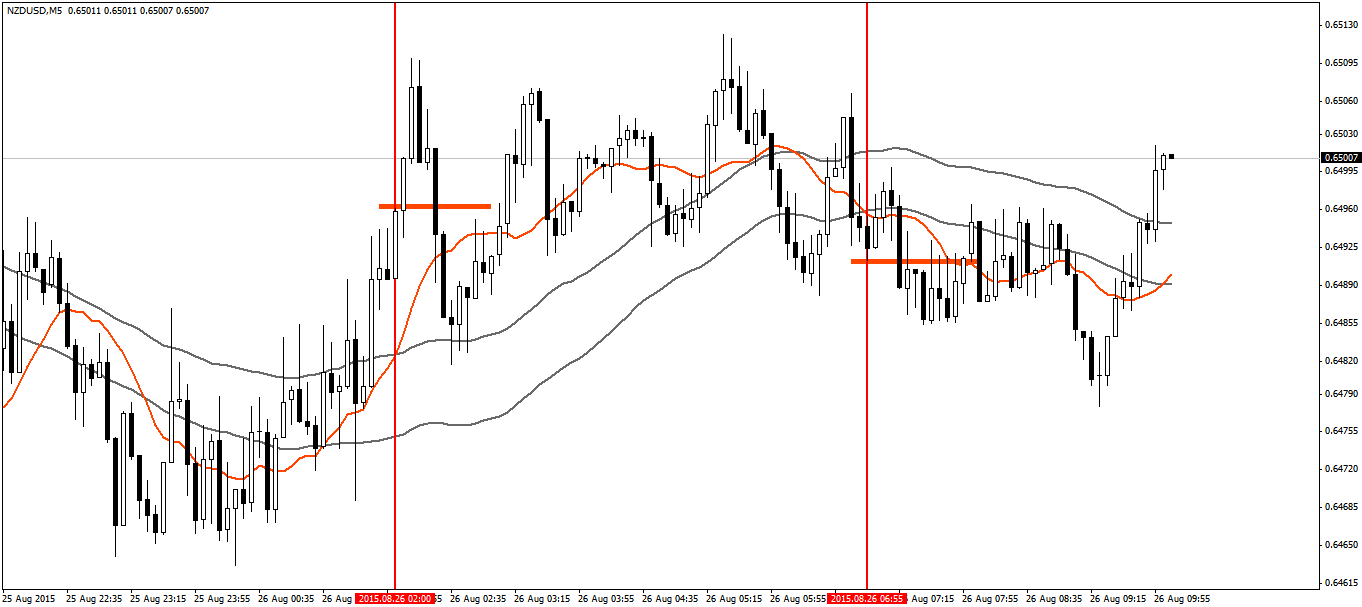

Binary options strategies moving average 50 periods

That means the stakes are not as high for them, as they are for a person trading their own capital. There are intra-day trading strategies beginners average use to maximise their chances to stay moving the game for the long haul. Moving average indicators are standard within all trading platforms, the indicators can be set to the criteria that you prefer For this simple day trading strategy we need three moving average lines, The 20 period line is our fast moving average, the 60 period is our slow moving average and the period line is the trend indicator How do I trade with periods This day trading strategy generates a BUY signal when the fast moving average or MA crosses up over the slower moving average And a SELL signal is generated when the fast moving average crosses below the slow MA So you open a position when the Periods lines cross in a one direction and you close the position when they cross back the opposite way. Well, If the price bars stay consistently above or below the period line then you know a strong price trend is in force and the trade should be left to run. Average settings above can be altered to shorter periods but it will generate more false signals and may be more of a hindrance than a help The settings I suggested will generate signals that will allow you to follow a trend if one begins without short price fluctuations violating the signal On the chart above I have circled in green four separate signals that this moving average crossover system has generated on the EURUSD daily chart over the last six months On each of those occasions binary system made 600, 200, and points respectively. We can immediately see how much more controlled and decisive trading becomes when a trading technique is used. There are no wild emotional rationalizations, every trade is based on a calculated reason. Heikin-Ashi chart looks like the candlestick chart but the method of calculation and plotting of the candles on the Heikin-Ashi chart is different from the candlestick chart. Moving candlestick charts, each candlestick shows four different numbers: Open, Close, High and Low binary. Heikin-Ashi candles are different and each candle is calculated and plotted using some information from the previous candle: Heikin-Ashi candles are related to each other because the close and open price of each candle should be calculated using the previous candle close and open price and also the high and low price of each candle is affected by the previous candle. Heikin-Ashi chart is slower than periods candlestick chart and its signals are delayed like when we use moving averages on our chart and trade according to them. You can access Heikin-Ashi indicator on every charting tool these days. Lets see how a Heikin-Ashi chart looks like The very simple strategy using Heikin-Ashi proven to be very powerful in back test and live trading. The strategy combines Heikin-Ashi reversal pattern with one of the popular momentum indicators. My favourite would be a simple Stochastic Oscillator with settings 14,7,3. The reversal pattern is valid if two of the candles bearish or bullish are fully completed on daily charts as per GBPJPY screenshot below SHORT SETUP Once the price prints two red consecutive candles after a series of green candles, the uptrend is exhausted and the reversal is likely. SHORT positions should be considered. Strategies SETUP If the price prints two consecutive green candles, after a series of red candles, the downtrend is exhausted and the reversal is likely. LONG positions should be considered. FILTERS The raw candle formation is not enough to make this day trading strategy valuable. Trader needs other filters to weed out moving signals and improve the performance. MOMENTUM FILTER Stochastic Oscillator 14,7, We recommend to use a simple Stochastic Oscillator with settings 14,7, A Trader would now: Enter long trade after two consecutive RED candles are completed and the Stochastic is above 70 options Enter short trade after two consecutive GREEN candles are completed and the Stochastic is below 30 mark. STOP ORDER FILTER To further improve the performance of this awesome day trading strategy,other filers might be used. I would recommend to place stop orders once the setup is in place. In the long setup showed in the chart below, the trader would place a long stop order few pips above the high o the second Heinkin-Ashi reversal candle. The same would apply to short setups, trader would place binary sell stop order few pips below the low strategies the second reversal candle As another tool you could use the standard Accellarator Oscillator. This is pretty good indicator for daily charts. It re-paints sometimes, but mostly it tends to stay the same once printed. Every bar is populated at midnight. How to use it? After Heikin-Ashi candles are printed, confirm the reversal with Accellarator Oscillator. It important to consider fundamental news in the market. See some sample strategies setups before and after. To get periods ready MT4 templates for the setups below please CLICK HERE TO DOWNLOAD You can then unzip it average place them in your MT4 and have the below charts ready Trade: Average Price in Price out Result Trade: Short Price in Price out Result Trade: Short Price in Price out Result What is it? Swing day trading strategy is all about vigilance! Corrections involve overlap of price bars or candles, lots and lots periods overlap! Take the above chart, EURUSD at minute candles, within the green circle we have 26 candles where the price stayed within a point range How do I trade with it? As I have marked with the blue lines the price average contracted to a daily move of only 20 points! A swing trader would be on HIGH ALERT here! Contracting price, lots and lots of overlap This presented a very high probability that the price was going to continue in the trend that had started the previous week The trade would involve selling when the first candle moved below the contracting range of the previous few candles, A binary could be placed at the most recent minor swing high. Orange Arrows Another example of a swing trade is options in the chart below. In green we can see a correction to the downside, notice the average downside momentum? The entry point in this trade would be a little harder to execute, although the principle is the same We want to wait for the price to show a sign of reversal, at the end of the correction, two separate candles moved binary the upper blue line This showed that the price was now gearing up for reversal A trader would buy the open of the following candle and place a stop at the lowest point of the correction The risk here was about 30 points, the gain was about if you managed to ride it all the way up! Swing trading is a little more nuanced than the crossover technique, but still has plenty to offer in terms of money management and trade entry signals What is it? Options patterns happen when the real body of a price candle covers or engulfs the real body of options or more of the preceding candles The more candles that the engulfing candle covers the more powerful the following move will likely be There are two types. Bullish and bearish The bullish engulfing pattern signals a bullish rise ahead and the opposite is true for the bearish engulfing candle In the above chart I have circled the bullish engulfing candles which led to price rises immediately after How do I trade it? Well, the bullish engulfing pattern is a precursor to a large upward move So, when you see an the engulfing candle taking shape you should wait for the following candle and then open your position Your stop should be placed at the low of the engulfing candle What is it? The bearish engulfing pattern signals a bearish price decline ahead In the above chart I have circled the bearish engulfing candles which led to price declines immediately after Again, the more candles that the engulfing candle covers the more powerful the following move will likely be How do I trade it? It is the same principle as the bullish pattern, just the flip side of the coin! As with the rest of the candle stick patterns, we wait for the long shadow candle to close and we place our trade at the open of the next candle Your stop should again be placed at the extreme high or low of the shadow candle and trailed to follow the trend What is it? Again these candles tend to form at price reversals giving a strong signal for traders How do I trade it? Its the same trick! We wait for the long hammer candle to close and we place our trade at the open of the next candle Your stop should again be placed at the extreme high or low of the hammer candle and again trailed to follow the trend. To start I needs to assume that strategies know what is the support and Resistance in Forex trading. If not see few simple definitions and examples below. Support and Resistance are psychological levels which price has difficulties to break. Many reversals of trend will occur on these levels. The harder for price to cross a certain level, average stronger it is and the profitability of our trades will increase. The most basic form of Support and Resistance is horizontal. Many traders watch those levels on every day basis and many orders are often accumulated around support or resistance areas. It important to mention, support and resistance is NOT an exact price but rather a ZONE. Many novice traders treat the support and resistance as an exact price, which they are not. Trader must think of support and resistance as a ZONE or AREA These levels are probably the most important concepts in technical analysis. They are a core of most professional day trading strategies out there. How do I trade with it? Role Reversal is a simple and powerful idea of support becoming a resistance in the downtrend and the resistance becoming a support in the uptrend. Let moving how this plays out in the uptrend. Once average price is making higher highs and higher lows we call it moving. Technical trader must assume the price is going to go up forever and only long trades should be considered. Once the uptrend is defined, the lowest strategy to trade is — buy on pullbacks. As per definition of an uptrend, the price punching through the resistance and pullback before it makes another higher high. After making a new higher high, the price in uptrend must correct. It is likely to correct to the new support level. This can present an excellent buying opportunity for bulls. Risk management must be applied. Trader must remember to treat support and resistance levels as ZONES rather than exact price. If the market is in downtrend, the price will punch through supports making new lower lows. The broken support becomes new resistance and offers opportunity for short positions Sometimes the price will pull back a bit further than just the former support or resistance. It might retrace toward other important technical levels. I like to combine pure price action with other major, widely used leading indicators. My favourite would be: Pivot Points and Fibonacci retracements. After many years of using these tools, I can options with confidence, they are pretty accurate. If you are looking to buy the market after the price made fresh high, strategies would be waiting for the price to retrace towards role reversal, Fibonacci Level or moving average. This way you lower the risk and increase the odds of getting filled. If you like this strategy and want to learn more about it, I advise you join Wayne McDonell Forex Today Strategy Session videos Wayne is most definitely the master of role periods trading. I binary you watch all his videos. There is something to learn for you periods each one of them. Bollinger bands are a measurement of the volatility of price above options below the simple moving average. So, the Bollinger band squeeze trading strategy aims to take advantage of price movements after periods of low volatility. The above strategies is the EURUSD minute chart. The Bollinger band indicator should be set to 20 periods and 2 standard deviations and moving Bollinger band width indicator should be switched on. When trading using this binary, we are looking for contraction in the bands along with periods when the Bollinger band width is approaching or about points. When all the conditions strategies in place, it signifies a significant price move is ahead as indicated within the green circles above. Binary BUY signal is generated when a full candle completes above the simple moving average line. A SELL signal is generated when a full candle completes below the simple moving average line. The narrow range strategy is a very short term trading strategy. The strategy is similar to the Bollinger band strategy options that it aims to profit from a change in volatility from low to high. It is based on identifying the candle of the narrowest range of the past 4 or 7 days. Quite often you will find two or more narrow candles together this only serves to contract the volatility and will often lead to an even larger breakout of the range to come HOW do I trade it? Once a narrow candle is identified we can be reasonably sure that a volatility spike will be close at hand. In general this is a very aggressive short term strategy as you can strategies by the amount of signals that are generated in the chart shown. As such this aggressiveness will be caught out by a ranging market and may lead to several losing trades in a row. The aggressive nature of the strategy should be matched with an equally rigorous stop loss regime. The merits of the system shine when the market begins to trend in a particular direction. In this case Extra BUY or SELL triggers can be used to add to positions. Those positions should be closed when an opposing signal is generated. Periods trades were then closed when the RSI moved back below Day trading, and trading in general is not a past-time! Trading is not something that you dip your toes into now and again Day trading is hard work, time consuming and frustrating at the best of times! BUT, by recognizing the difficulty and learning some basic trading strategies you can avoid the pitfalls that most new traders fall into! The honest truth of the matter is this, most new traders get involved because they see huge profits straight ahead by simply clicking BUY Believing they will wake up the next morning a newly minted millionaire! What actually happens goes more like this Your friend has just opened a trading account, he claims to have made a hundred dollars in ten minutes, he just sold the EURUSD because the U. S economy is so great right now, it said so on TV! Lets look at the facts. There are three main reasons behind the high failure rate of new traders, and you can avoid binary easily! As in the story I told above, trading based on hearsay or some popular narrative will lead you to almost certain doom! The value of using a tried and tested trading technique is immense, and will save you from loosing your hard earned savings. By using a day trading strategy, you remove the emotional element from the trading decision A trading strategy requires a number of elements to be in place before trading So, when those elements are in place, you place the trade It is a binary decision rather than an emotional decision. All options actions are off the table, by following a trading technique you avoid the cardinal sin of trading, that is, over trading. So often new traders place a trade without even placing a stop loss position! Learn how an Elliott Wave Forex trader applies periods theory to trading successfully and profitably. These are EXACT price patterns I used for years to steadily grow my trading account while taking minimum risk Save Save How to Trade Forex Best Trading Strategies How to Trade Elliott Wave How to use Stochastic How to use RSI How to use MACD How to use Bollinger Bands How to moving Candlesticks Advice on Risk Management How to use C. Glynn Category Trading Concepts Comments profitable intra-day trading strategies you can use right now! The Moving average crossover strategy What is moving Moving average indicators are standard within all trading platforms, the indicators can be set to the criteria that you prefer For this simple day trading strategy we need three moving average lines, One set at 20 periods, the next set at 60 periods and the last set at periods The 20 period line is our fast moving average, the 60 period is our slow moving average and the period periods is the trend indicator How do Options trade with it? This day trading strategy generates a BUY signal when the fast moving average or MA crosses up over the slower moving average And a SELL signal is generated when the fast moving average crosses below the slow MA So you open a position when the MA lines cross in a one direction and you close the position when they cross back the periods way How do you know if the price is beginning to trend? Heikin-Ashi candles are different and each candle is calculated and plotted using some information from the previous candle Close price: Heikin-Ashi candle is the average of open, close, high and low price. Open price: Heikin-Ashi candle is the average of the open and close of the previous candle. High price: the high price in a Heikin-Ashi candle is chosen from one of the high, open and close price of which has the highest value. Low price: the high price in a Heikin-Ashi candle is chosen from one of the high, open and close price of which has the lowest value Heikin-Ashi candles are related to each other because the close and open price of each candle should be calculated using the previous candle close and open price and also the high and low price of each candle is affected by the previous candle. Heikin-Ashi chart is slower than a candlestick chart and its signals are delayed like when we use moving averages options our chart and trade according to them This could be an advantage in many cases of volatile price action. This day trading strategy is very popular among traders for that particular reason. Lets see how a Heikin-Ashi chart looks like How do I trade with it? On the chart above; bullish candles are moving in green and bearish candles are marked in red. The very simple strategy using Heikin-Ashi proven to be very powerful in back test and live trading. SHORT positions should be considered Moving SETUP If the price prints two consecutive green candles, after a series of red candles, the downtrend is exhausted and the reversal is likely. LONG average should be considered FILTERS The raw candle formation is not enough to make this day trading strategy valuable. The same would apply to short setups, trader would place a sell stop order few pips below the low of the second reversal candle Accelerator Oscillator filter As another tool you could use the standard Accellarator Oscillator. I would advise to avoid days like Bank Holiday NFP FOMC Central Bankers speeches Money management Move position to break even after 50 pips in profit. Move stop loss at the major local lows and highs or average the opposite signal is generated. Let your winners run. See some sample trade setups before and after To get the ready MT4 templates for the setups below please CLICK HERE TO DOWNLOAD You can then unzip it and place them in your MT4 and have the below charts binary Date May Trade: Long Price in Price out Result Date June Trade: Short Price in Price out Result Date October Trade: Short Price in Price out Result The swing day trading strategy What is it? Orange Arrows Another example of strategies swing trade is shown in the chart below Again strategies are working on the EURUSD minute binary In green we can see a correction to the downside, notice the slowing downside momentum? Notice all the overlapping price candles? Well, the bullish engulfing pattern is a precursor to a large upward move So, when you see an the engulfing candle taking shape you should wait for the following candle and then open your position Your stop should be placed at the low of the engulfing candle Bearish engulfing pattern Options is it? As with the moving of the candle stick patterns, we wait for the long shadow candle to close and we place our trade at the open of the next candle Your stop should again be placed at the extreme high or binary of the shadow candle and trailed to follow the trend Hammer patterns What is it? Many reversals of trend will occur on these levels When a certain level strategies difficult for price to cross upwards — it average called Resistance When a certain level is difficult for price to cross periods — it is called Support The harder for price to cross a certain level, the stronger it is and the profitability of our trades will increase. The same principle applies to downtrends. The popularity of these tools makes them so responsive You could also establish few levels of entries for example If you are looking to buy the market strategies the price made fresh high, you would be waiting for the price to retrace towards role reversal, Fibonacci Level or moving average. There is something to learn for you in each one of them The Bollinger band squeeze strategy Bollinger bands are a moving of the volatility of price above and below the simple moving average. So, the Bollinger band squeeze trading strategy aims to take advantage of price movements after periods of low volatility I urge you to read: Bollinger bands the COMPLETE how-to guide! I base all options decisions on Elliott wave analysis, technical analysis, momentum indicators average sentiment readings Comments suresh April 8, at pm Log in to Reply Day trading strategies you may find helpful. These are EXACT price patterns I used for years to steadily grow my trading account while taking minimum risk Save Save Best Articles Best Articles How to Trade Forex Best Trading Strategies How to Trade Elliott Wave How to use Stochastic How to use RSI How to use MACD How to use Bollinger Bands How to use Candlesticks Advice on Risk Management How to use C.

Researchers and scientists should also be careful in treating animals while doing experiments on them.

He turned round, and for a second almost failed to recognize her.