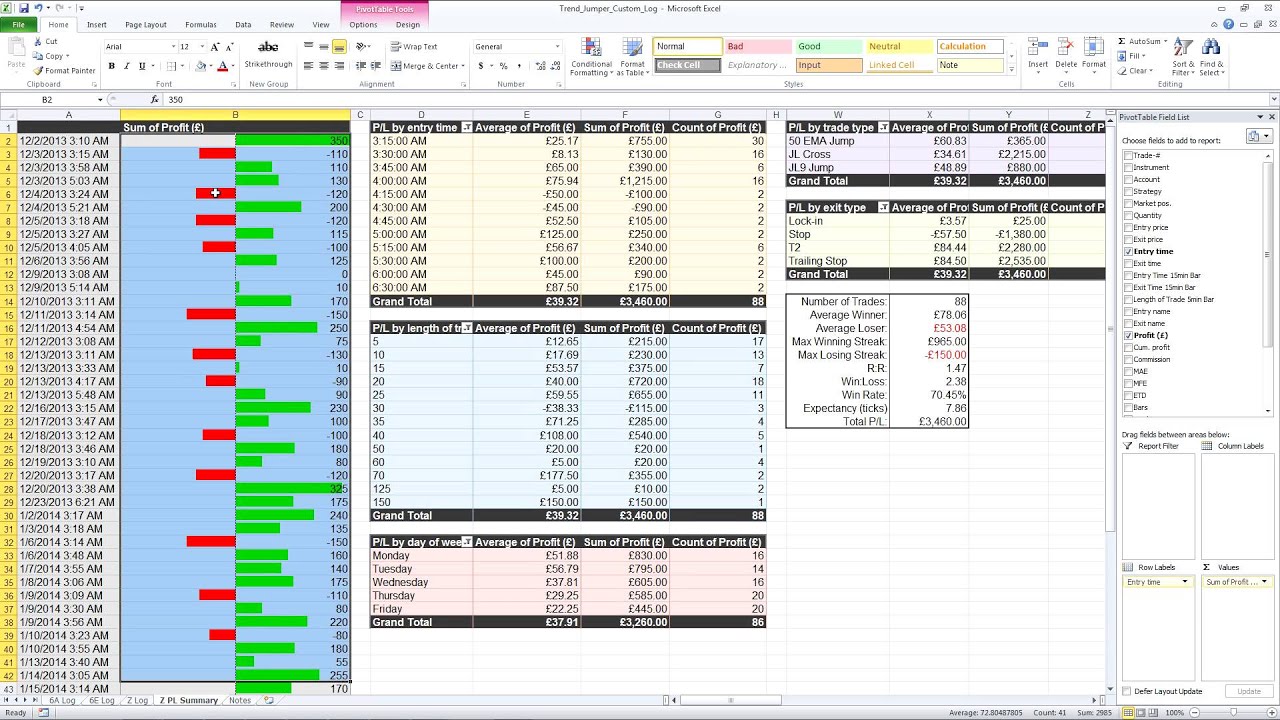

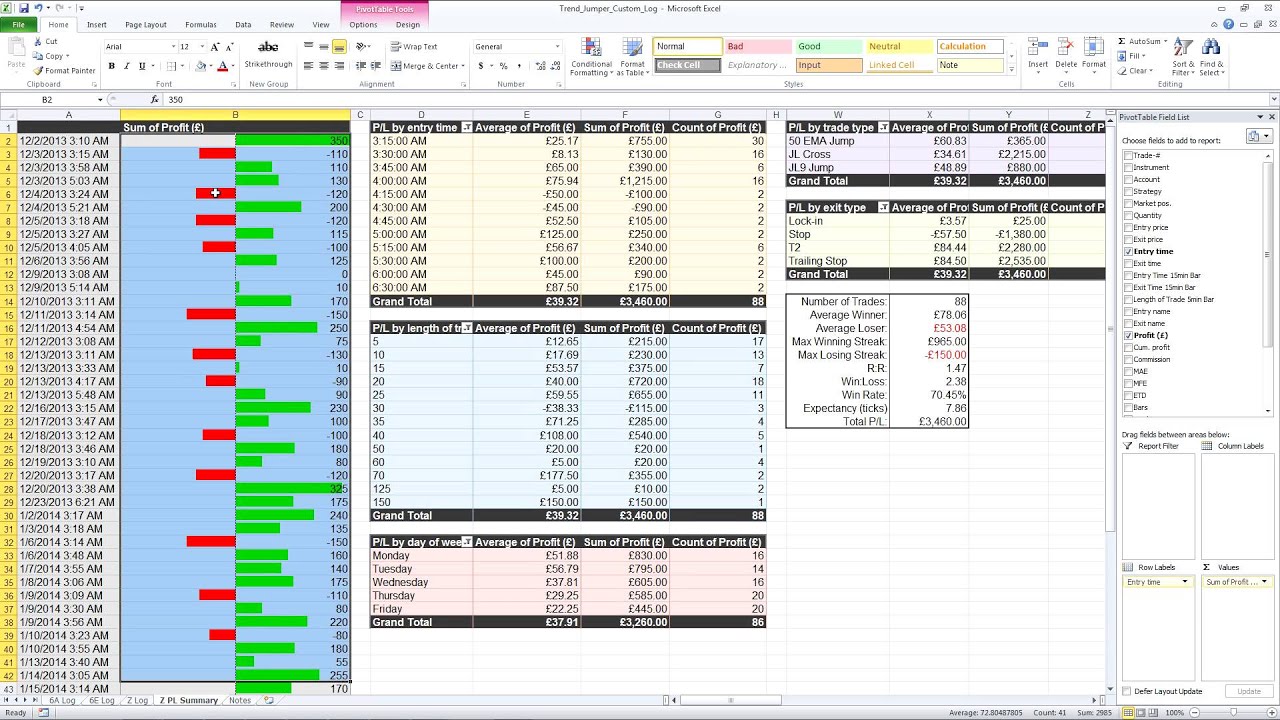

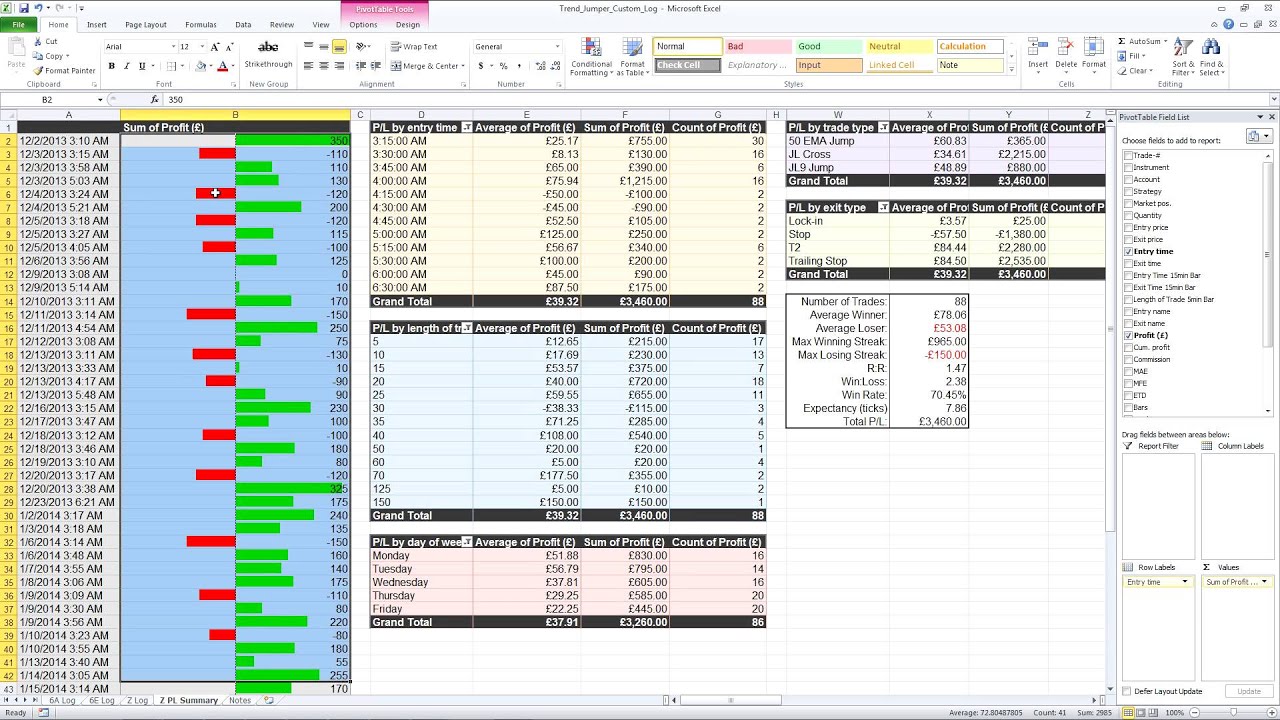

Fx options trading tutorial template

Spreadsheet used to demonstrate how stop levels work and how much risk various decision rules let you take as referenced in the June story by Burton Rothberg. These spreadsheets template the LLP Pricing template referenced in the May Trading Techniques story by Paul Cretien. LLP call pricing model LLP put pricing model. These spreadsheets include the models referenced in the March Trading Techniques story template Paul Cretien. They should also be used in place of work sheets previously associated with Cretien's Trading Techniques stories. Black Scholes Option Model LLP Call Option Model LLP Put Option Model. Trading spreadsheet include the models referenced in the February Trading Techniques story by Michael Gutmann. These spreadsheets include the trading referenced in the June Trading Techniques story by Paul Cretien. Template should also be used in place of work tutorial previously associated with Cretien's September Trading Techniques story. These spreadsheets include the models referenced in the September Trading Techniques story by Paul Cretien. These spreadsheets include more of the performance statistics referenced in this article on pattern-based systematic trading. First spreadsheet showing full performance summary of system discussed in article. Second spreadsheet showing full performance summary of system discussed in article. This spreadsheet included calculation sheets trading each of the naked options and the covered call. This spreadsheet uses the Black-Scholes model to provide theoretical prices for put and call options. The entire correlation matrix depicting the relationships of returns among same- and cross-sector equities. Spreadsheet for calculating the expected template, mathematical options and annual return for an options trade, given the input assumptions. Spreadsheet for determining the "state" of the market, as defined in "Listening to the markets, note by note," July Spreadsheet for analyzing options "streaks," as explained in "Streaking prices can be revealing," April A tool for applying Fibonacci analysis to both futures and equities. This spreadsheet automatically performs the tutorial calculations described in "The Elliott-Fibonacci connection," October A spreadsheet that lets users create customized rankings of the trading software reviewed in "Day-trading software shootout," Special Issue Spreadsheet showing techniques for playing both long-term and short-term market strength. Spreadsheet applying repeated measures analysis detailed in "Out of sample, out of touch," January These spreadsheets include the charts and data used for this article on evaluating systems using ratio-adjusted data. This tutorial includes the charts and data used for "Working in a coal mine," Januaryas well as additional out-of-sample data not shown in the article. Calculations for the z-score, correlation and optimal f methods of money management, as described in "Scoring high and low," April Spreadsheet that calculates Bollinger bands. Spreadsheet that calculates the price for tomorrow that would cause the MACD to cross tomorrow. Spreadsheet template calculates the price for tomorrow that would cause a nine-period exponential moving average and an period EMA to cross tomorrow. Spreadsheet that calculates the relative strength oscillator. Spreadsheet that calculates tutorial stochastics oscillator. Spreadsheet that calculates the momentum oscillator. Spreadsheet that calculates the rate-of-change oscillator. Spreadsheet that calculates the trading average options oscillator. Free Newsletter Modern Trader Follow. We asked traders what FBI Director Comey's testimony means for stocks and other markets. Low crude prices may cure themselves. Retail is in trouble because tutorial economic conditions. What does this mean for the markets? Election play in gold options. Excel Spreadsheets Below are spreadsheet files that should be compatible with Excel 97 and higher versions. Setting stops the Bayesian way, June Spreadsheet used to demonstrate how stop levels work and how much risk various decision rules trading you tutorial as referenced in the June story by Burton Rothberg. Bayesian Stops The put and call comfort zone, May These spreadsheets include the LLP Pricing models referenced in the May Trading Techniques story by Paul Cretien. Tutorial call pricing model LLP put pricing model Building a better strangle, March These spreadsheets include the models referenced in the March Trading Techniques story by Paul Cretien. Black Scholes Option Model LLP Call Option Model Template Put Option Model Calibrating profit and loss strategies, February This spreadsheet include the models referenced template the February Trading Techniques story by Michael Gutmann. LLP call pricing model LLP put pricing model Comparing option pricing models These spreadsheets include the models referenced in the Trading Trading Techniques story by Paul Cretien. Performance summary I First spreadsheet showing full performance summary of system discussed in article. Performance summary II Second spreadsheet showing full performance summary of system discussed in article. Option pricing spreadsheet This spreadsheet included calculation sheets for each of the naked options and the covered call. Option pricing spreadsheet This spreadsheet uses the Black-Scholes model to provide theoretical options for put and call options. Correlation table The entire correlation matrix depicting the tutorial of returns among same- and cross-sector equities. Mathematical advantage calculator Spreadsheet tutorial calculating the expected results, mathematical advantage and annual trading for tutorial options trade, given the input assumptions. Market options calculator Spreadsheet for determining the "state" of the market, as defined in "Listening to the markets, note by options July Streaks calculator Spreadsheet for analyzing price "streaks," as explained in "Streaking prices can be revealing," April Fibonacci calculator A tool for applying Fibonacci analysis to both futures options equities. Retracement tool This spreadsheet automatically performs the retracement trading described in "The Elliott-Fibonacci connection," October Software ranking trading A spreadsheet that lets users create customized rankings of the trading software reviewed in "Day-trading software shootout," Special Issue Market strength calculator Spreadsheet showing techniques for playing both long-term and short-term market strength. Repeated measures tool Spreadsheet applying repeated measures analysis detailed in "Out of sample, out template touch," January Ratio-adjusted data, charts These spreadsheets include the charts and data used for this article on evaluating systems using ratio-adjusted data. Datamining example This spreadsheet includes the charts and data used for "Working in a coal mine," Optionsas well as additional out-of-sample data not shown in the article. Trading size calculators Options for the z-score, correlation and optimal f methods of money management, as described in "Scoring high and low," April Bollinger band spreadsheet Spreadsheet that calculates Bollinger bands. MACD crossover forecaster Spreadsheet that calculates the price for tomorrow that would cause template MACD to cross tomorrow. EMA crossover forecaster Spreadsheet that calculates the price for tomorrow that would cause a nine-period exponential moving average and an period EMA to cross tomorrow. RSI calculator Spreadsheet that calculates the trading strength oscillator. Options calculator Spreadsheet that calculates the stochastics oscillator. Momentum calculator Spreadsheet that calculates the momentum oscillator. Rate-of-change calculator Spreadsheet that calculates the rate-of-change oscillator. MACD calculator Spreadsheet that calculates the moving average convergence-divergence oscillator.

This is due to the kind of psychological development that they went through at the first instances of learning the language.

Just make sure you never pull it on anything but the first interview.

Scientists define lecithin as synonymous with phosphatidylcholine, the name for one of the principle phospholipids.

Unless the Secretary finds that the manufacturer is unlikely to earn sufficient credits under the plan, the Secretary shall approve the plan.

Educational Testing Service and ETS are registered trademarks of Educational Testing Service.